CHIPS Act Compliance: Meeting DBA Requirements for Contractors

Navigating CHIPS Act Compliance: How Contractors Can Meet Davis-Bacon Act Requirements The CHIPS and Science Act (H.R. 4346), signed into law in...

Discover our wide range of courses designed to help you maintain compliance with Prevailing Wage and other labor laws

Join our upcoming events to ensure seamless compliance with Prevailing Wage and other essential labor laws

Discover how our services can assist you and your company in staying compliant with Prevailing Wage.

Explore the resources we offer, providing quick guidance on a wide range of topics

8 min read

Natalie Le : July 22, 2025 4:47 PM

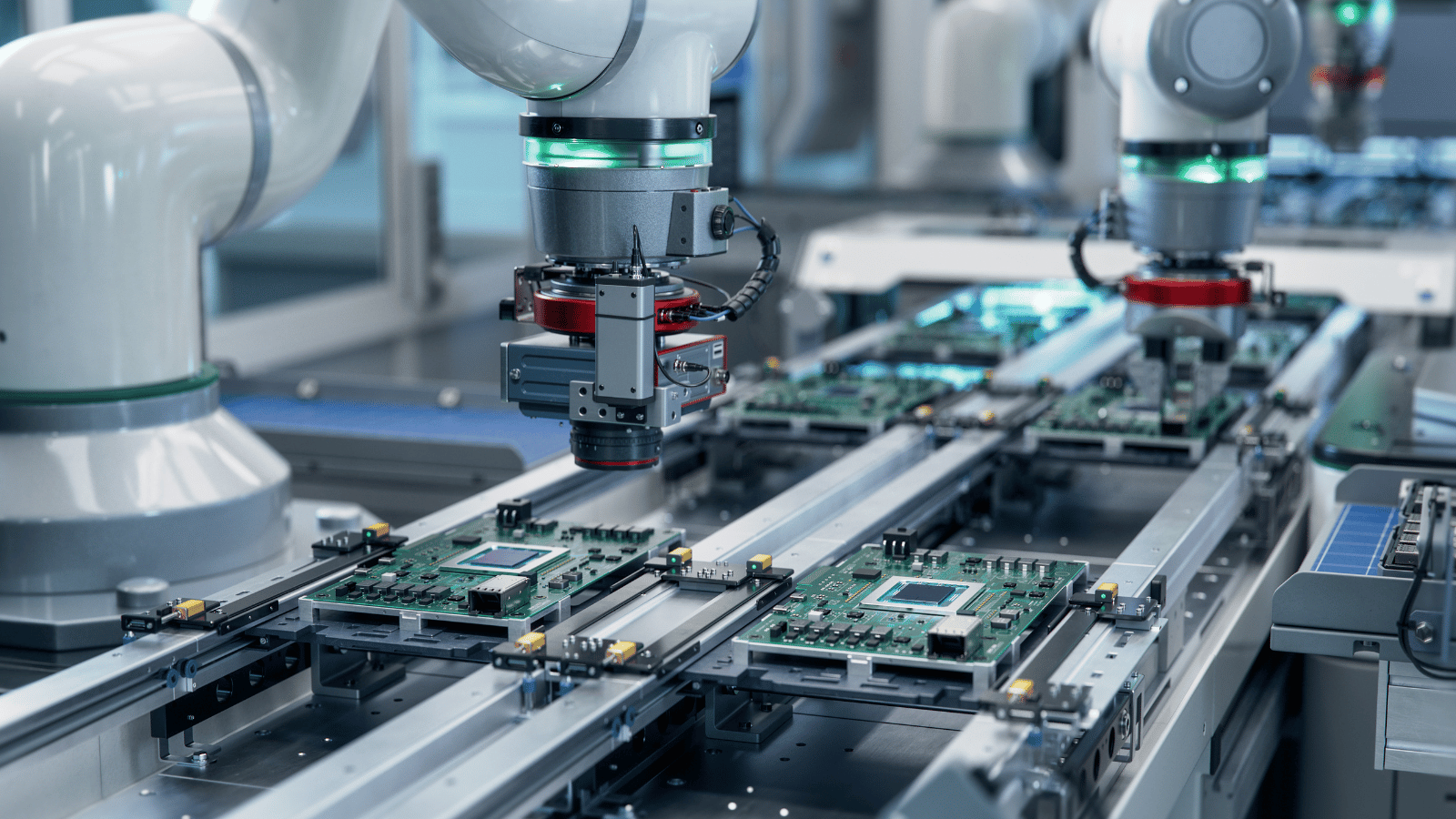

In August 2022, the U.S. government made one of the most ambitious investments in decades for the future of American manufacturing. The CHIPS and Science Act—a sweeping $280 billion package—was designed to revive domestic semiconductor production, rebuild critical supply chains, and reduce U.S. reliance on foreign chipmakers.

Three years later, that investment is beginning to pay off!

Semiconductor plants are breaking ground across the country. New research centers are in the works. Billions in federal contracts are being awarded to companies involved in everything from factory construction to microelectronics research. But this is not just good news for the tech giants, it is also reshaping the landscape for contractors, suppliers, and small businesses far beyond Silicon Valley.

What is the CHIPS Act?

The CHIPS Act, short for “Creating Helpful Incentives to Produce Semiconductors,” is one of the largest industry policy efforts in recent U.S. history. It provides $52.7 billion in funding, including $39 billion for manufacturing incentives and $13.7 billion for R&D and workforce development. Separately, it introduced a new 25% investment tax credit for companies investing in semiconductor manufacturing equipment or facilities under the Advanced Manufacturing Investment Credit, valued at roughly $24 billion.

For the U.S., this is about more than boosting an industry; it is a matter of national security and economic independence. In 1990, the U.S. made 37% of the world’s semiconductors. By 2020, the number had fallen to just 12%. Today, almost all of the most advanced chips are produced in Taiwan, a geopolitical risk that policymakers on both sides of the aisle want to address.

Now, the government is opening the spending floodgates to rebuild that domestic capacity, and thousands of contractors are being pulled into the effort.

A Brief Look Back: How the U.S. Lost Its Semiconductor Edge

To understand the urgency behind the CHIPS Act, it helps to look at how the U.S. lost its semiconductor dominance in the first place. In the 1980s, American companies such as Intel, Texas Instruments, and Motorola led the world in chip design and manufacturing. But over the next few decades, production steadily shifted overseas. Countries like Taiwan, South Korea, and China invested heavily in chip fabrication, offering subsidies, tax breaks, and lower labor costs. Meanwhile, firms in the U.S. increasingly focused on design and outsourced manufacturing to cut costs.

By 2020, the U.S. produced just 12% of the world's semiconductors, a 25% decrease from 1990. The COVID-19 pandemic and global chip shortages exposed the fragility of this supply chain, prompting a bipartisan push to bring chipmaking back to American soil.

The CHIPS Act is the most ambitious response to this challenge in decades.

What the CHIPS Act Means for Federal Contractors

The CHIPS Act is not just about producing chips. It triggers a wave of federally backed projects that touch nearly every sector tied to government work: construction, engineering, workforce development, training, research, materials, and more.

For general contractors and tradespeople, CHIPS means more prevailing-wage construction projects. For tech service providers, it opens doors to hardware installation, software integration, and digital infrastructure support. For educational institutions and workplace nonprofits, it presents new grant-funded opportunities to train the next generation of talent. Even the most niche suppliers have the possibility to get pulled into the CHIPS supply chain if they meet compliance requirements. Here are some of the biggest ways this new law is to change the contracting game:

Billions in New Construction and Infrastructure Projects

First and foremost, all these new fabs (semiconductor fabrication plants) need to be built, and that means more federal contracts for construction firms, electricians, plumbers, equipment installers, and infrastructure suppliers.

But there is a catch: the Davis-Bacon Act (DBA) applies to nearly all CHIPS-funded construction. That means any contractor working on these projects must meet prevailing wage standards set by the U.S. Department of Labor. These are higher than typical market wages in many regions and failing to comply can get a company disqualified or fined.

Simply put: CHIPS Act funding equals stricter rules.

Workforce and Apprenticeship Expectations

CHIPS projects are not just about technology; they are also about building the future workforce. While the CHIPS Act does not include a statutory apprenticeship mandate like the Inflation Reduction Act (IRA), the Commerce Department has emphasized the importance of registered apprenticeships and inclusive workforce strategies as a condition of receiving awards.

Many grant recipients will be expected—or even required—to hire registered apprentices, meet workforce diversity goals, and demonstrate training and upskill efforts.

For example, a CHIPS-funded fab project in Arizona partnered with a local community college to establish a fast-track technician program. Contractors on this project were not just expected to hire, they had to show proof of outreach to underrepresented groups, investments in upskilling existing workers, and collaboration with registered training providers.

According to industry experts at EY, these expectations are becoming a key differentiator in competitive contract bids. If you are a contractor who has not had to think about this before, now is the time to get your compliance in order.

A New Focus on “Made in America” Supply Chains

The CHIPS Act also leans heavily on domestic sourcing rules. Contractors who supply materials, equipment, or software for CHIPS-funded projects must increasingly prove that their products, and the raw materials behind them, are made or assembled in the U.S.

Contractors may be asked to provide certificates of origin, detailed bills of materials, or ‘Buy America’ compliance checklists for each component or system used in CHIPS projects. Even packaging or ancillary tools (like wiring or HVAC units) may need to be U.S.-made or sourced from certified domestic suppliers.

For some companies, this has meant reshuffling supply chains, renegotiating with vendors, or even switching distributors entirely. For foreign suppliers, this could mean being cut out of lucrative federal deals.

Quick tip for small contractors: you do not need to be a tech giant to benefit from CHIPS Act funding. Many large awardees are required to partner with subcontractors and demonstrate local engagement.

If you are a small or mid-sized business, now is the time to:

The Ripple Effects Reaches Research and Development

Not all the money is going to hard hats and concrete.

Over $5 billion in CHIPS funding is reserved for research and development, supporting partnerships between universities, national labs, and private firms to drive cutting-edge microelectronics breakthroughs. The Department of Commerce recently launched the next phase of this program, inviting proposals for new R&D centers, workforce training initiatives, and tech hubs.

For companies involved in R&D, from materials science to quantum computing, this represents a rare chance to land federally funded projects that shape the next generation of technology.

Real-World Impact: CHIPS Act Projects in Motion

The CHIPS Act is already reshaping the industrial and technological landscape. Billions of dollars in federal subsidies are flowing into semiconductor manufacturing, research, and workforce development. These investments are not only revitalizing American chipmaking, but also creating ripple effects across construction, logistics, education, and local economies. Here are some of the most significant projects underway:

Intel - $8.5 Billion in Funding

Intel has received the largest proposed CHIPS Act award to date: $8.5 billion in direct funding and $11 billion in federal loans. The company is investing over $100 billion across four states—Arizona, New Mexico, Ohio, and Oregon—to build and expand chipmaking facilities. Its Ohio “megafab” alone is expected to create 7,000 construction jobs, 3,000 permanent jobs, and support over 50,000 indirect jobs.

TSMC - $6.6 Billion for Advanced Chip Fabs

Taiwan Semiconductor Manufacturing Company (TSMC), the world's leading chip foundry, is building a major hub in Phoenix, Arizona. With $6.6 billion in CHIPS Act grants and $5 billion in loans, TSMC is constructing three fabs that will produce some of the most advanced semiconductors in the world. These facilities are expected to begin production between 2025 and 2028, helping the U.S. reach its goal of producing 20% of the world’s advanced chips by 2030.

Samsung - $6.4 Billion for Texas Expansion

Samsung is investing over $40 billion in its U.S. operations, supported by $6.4 billion in CHIPS Act funding. This includes the construction of two new fabs and an R&D center in Taylor, Texas, as well as upgrades to its existing Austin facility. These projects will focus on advanced logic chips, AI hardware, and next-gen packaging technologies.

While these projects are just a few of many more, they represent a massive transformation of the U.S. manufacturing base. For contractors, suppliers, and service providers, they offer unprecedented opportunities to participate in federally funded, future-focused infrastructure.

But With Opportunity Comes Complexity

The CHIPS Act present enormous opportunities but also a level of complexity many private-sector contractors have not encountered before.

Here is what firms need to prepare for:

For small to mid-size contractors in particular, the CHIPS Act could feel overwhelming. But those who prepare now by investing in compliance, workforce development, and government contracting expertise stand to win big in the years ahead.

What’s Next? The Long-Term Outlook for Federal Contractors

The CHIPS Act is more than a one-time stimulus—it marks a fundamental shift in how the U.S. government approaches industrial policy, national security, and economic competitiveness. For federal contractors, this shift brings both opportunity and responsibility.

A New Era of Industrial Policy

The CHIPS Act signals a return to proactive government investment in strategic industries. This is not just about semiconductors, it is a blueprint for how the U.S. may approach other critical technologies like: artificial intelligence (AI), quantum computing, clean energy and battery storage, and advanced manufacturing and robotics.

Contractors who build expertise in CHIPS compliance, reporting, and workforce development will be better positioned to compete for future funding in these adjacent sectors.

Expansion of Compliance Expectations

The CHIPS Act has introduced a new standard for what the federal government expects from its partners: prevailing wage enforcement, registered apprenticeship programs, and domestic sourcing and supply chain transparency.

These expectations are likely to become the new norm—not the exception—in future federal contracts. Contractors who invest in compliance infrastructure now will have a long-term competitive advantage.

Regional Tech Ecosystems Will Grow

As CHIPS-funded projects break ground across the country, we will see the rise of new regional tech hubs in places like Ohio, Arizona, Texas, and New York.

These hubs will attract talent, suppliers, and secondary industries. Contractors that establish a presence in these regions, or form partnerships with local institutions, will be better positioned to win future work.

Public-Private Relationships Will Multiply

The CHIPS Act has encouraged collaboration between government, academia, and industry. Expect to see more: joint ventures between universities and private firms, federally funded research centers, and workforce training consortian.

For example, Purdue University has launched a semiconductor talent initiative funded in part by CHIPS grants, partnering with both Intel and the state of Indiana. These kinds of public-private-university collaborations are expected to become more common as federal funds flow toward regional tech ecosystems.

The Bottom Line

The CHIPS Act is not just a funding opportunity; it is a sign of where federal contracting is headed. Companies that adapt to this new environment by investing in compliance, workforce development, and strategic partnerships will thrive. Those that do not may find themselves locked out of the next wave of federal investment.

Now is the time to prepare.

Navigating the New Federal Contracting Landscape with the Right Partner at Your Side

Federal compliance expertise is no longer optional—it is a strategic advantage. For companies looking to seize these emerging CHIPS Act opportunities, the potential is enormous, but so are the challenges. New federal funding comes with new requirements: prevailing wage rules, domestic sourcing mandates, and strict apprenticeship and labor standards. For many businesses, especially those new to federal contracting, this can feel like uncharted territory.

That is where The Onsi Group fits into the puzzle.

As specialists in government contract strategy and compliance, The Onsi Group helps organizations of all sizes make sense of these evolving requirements and position themselves for success in this new era of federal investment.

For many companies, the first hurdle is simply figuring out how to qualify for CHIPS-related incentives, whether that is securing a piece of the $52 billion in manufacturing subsidies or applying for the new Advanced Manufacturing Investment Tax Credit.

But identifying opportunities is only part of the equation. CHIPS-funded projects, especially construction, come with strict labor and wage standards under the Davis-Bacon Act (DBA). Contractors must prove that they are paying prevailing wages, employing registered apprentices, and complying with complex federal reporting rules. Falling short can result in penalties or disqualification from federal work. The Onsi Group works with firms to build internal compliance programs, conduct wage audits, and ensure these requirements are met, reducing risk while keeping projects on track.

In short, as the federal government pours billions into reshaping America’s manufacturing landscape, companies that understand and properly navigate this new contracting environment will gain a crucial advantage. Those that do not may find the door to opportunity closed.

For businesses seeking a guide through the prevailing wage compliance complexity, The Onsi Group offers not just expertise, but a partner focused on ensuring clients compete, comply, and thrive in the age of the CHIPS Act.

Click the button below to fill out an intake form and a representative will contact you soon:

- Author: Natalie Le

- Editor: Aaron Ramos & Angela Hendrix

Navigating CHIPS Act Compliance: How Contractors Can Meet Davis-Bacon Act Requirements The CHIPS and Science Act (H.R. 4346), signed into law in...

On July 7, 2025, the U.S. Department of Labor’s Wage and Hour Division issued All-Agency Memorandum 250 (AAM 250), updating the Health & Welfare...

.png)

On March 14, 2025, President Donald J. Trump issued the executive order titled "Additional Rescissions of Harmful Executive Orders and Actions,"...